Nvidia is now the most valuable public corporation in the world. It has long been well-known in the specialized gaming industry for its graphics hardware.

In noon trading on Tuesday, the chipmaker’s share price increased by 3.2%, surpassing Microsoft’s market capitalization of $3.33 trillion. Nvidia overtook Apple earlier this month to reach a $3 trillion market capitalization for the first time.

This year, Nvidia’s share price has increased by almost 170%, and it continued to rise following the company’s May first-quarter results announcement. The gain in the stock price since the end of 2022 has been more than nine times, and this increase has been correlated with the development of generative artificial intelligence.

The company is also thinking about getting into the portable gaming market since there are now no Nvidia-based alternatives.

Read related article: Nvidia’s Potential Venture into the Portable Gaming PC Market in 2024

As OpenAI, Microsoft, Alphabet, Amazon, Meta, and other companies swarmed to snatch up the processors required to construct AI models and handle ever-larger workloads, Nvidia commanded about 80% of the market for AI chips used in data centers.

In the last quarter, its data center division generated $22.6 billion in revenue, up 427% year over year and making up almost 86% of the chipmaker’s overall revenues.

Apple’s market capitalization is $3.28 trillion after its shares fell by around 1% during Tuesday’s trade. Microsoft’s market value, which is $3.32 trillion, decreased by less than a percentage point.

Nvidia’s Rise to Power: AI Chip Market Leader with $22.6 Billion Revenue

Nvidia was founded in 1991 and mostly operated as a hardware firm, selling chips to players so they could play 3D games in the early years. It has also experimented with cloud gaming subscriptions and mining chips for cryptocurrencies.

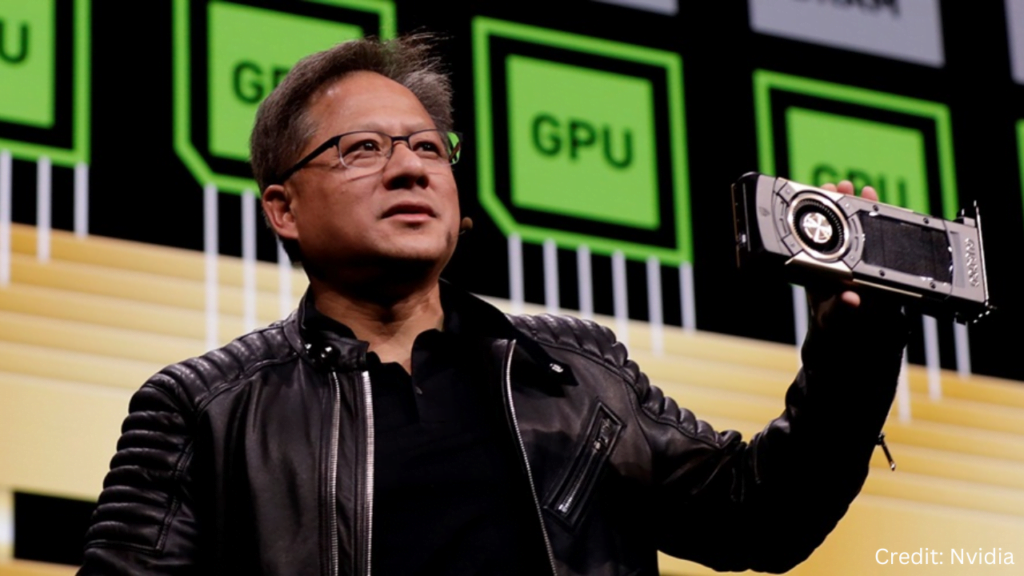

However, its stock has surged over the last two years as Wall Street began to acknowledge the company’s technology as the driving force behind the AI growth, which doesn’t appear to be slowing down. Thanks to the rally, co-founder and CEO Jensen Huang’s net worth increased to over $117 billion, ranking him as the eleventh richest person in the world by Forbes.

This year, Microsoft’s stock has increased by almost 20%. Since acquiring a sizable interest in OpenAI and incorporating the startup’s AI models into its most key products, such as Office and Windows, the software giant has also benefited greatly from the AI boom. Microsoft is a major purchaser of graphics processing units (GPUs) from Nvidia for use in its Azure cloud service. The company just unveiled Copilot+, a new line of laptops built to run its AI models.

Read related article: Microsoft surpasses $3 trillion market cap, securing second place to Apple

Nvidia has recently emerged as the most valued U.S. company. Microsoft and Apple have been exchanging titles for the last few years.

Due to its quick rise, it is still not listed on the Dow Jones Industrial Average, which is a stock benchmark comprising 30 of the most valuable American companies. Nvidia stated last month that it will split its shares 10 for 1 starting on June 7 in conjunction with the announcement of its earnings.

Due to the split, Nvidia has a greater chance of being included in the Dow, a price-weighted index that favors businesses with higher stock prices over those with larger market capitalizations.